It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information.

Returns Over Time

Other percentages and measures can be used to calculate the return, such as the logarithmic rate of return, internal rate of return, return on investment, return on equity, etc. The arithmetic mean return provides a simple measure of average return over multiple periods but does not account for the compounding effect. It assumes that returns in each period are independent and do not affect subsequent returns. Firstly, both ROI and ROE are simple methods of an absolute evaluation of investment profitability. The characteristic feature of ROI and ROE is that they are single-periods methods, and they do not have the same value for the entire duration of the investment. In addition, neither ROI nor ROE takes TVM (which you can read more about in our time value of money calculator) into account.

How to Calculate Rate of Return in Excel: Step 4

Returning to the Apple example, we’ll start by considering buying stock from the company. While this 10% is not earned consistently each year, the IRR just smooths out the return. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible.

Great! The Financial Professional Will Get Back To You Soon.

Conversely, the formula can be used to compute either gain from or cost of investment, given a desired ROI. If Bob wanted an ROI of 40% and knew his initial cost of investment was $50,000, $70,000 is the gain he must make from the initial investment to realize his desired ROI. In conclusion, our ROI calculator can help you make the most beneficial financial decision for you, completing many different cost-benefit analysis’s in no time. Moreover, with the mobile version of our return on investment calculator you are able to compute ROI whenever and wherever you want.

How to Calculate Rate of Return in Excel

It provides a straightforward measure of investment performance over a specific period. But it doesn’t consider the compounding effect or the performance over multiple periods. The amount of this change depends to a large degree on how long you hold onto your investment.

Create a Free Account and Ask Any Financial Question

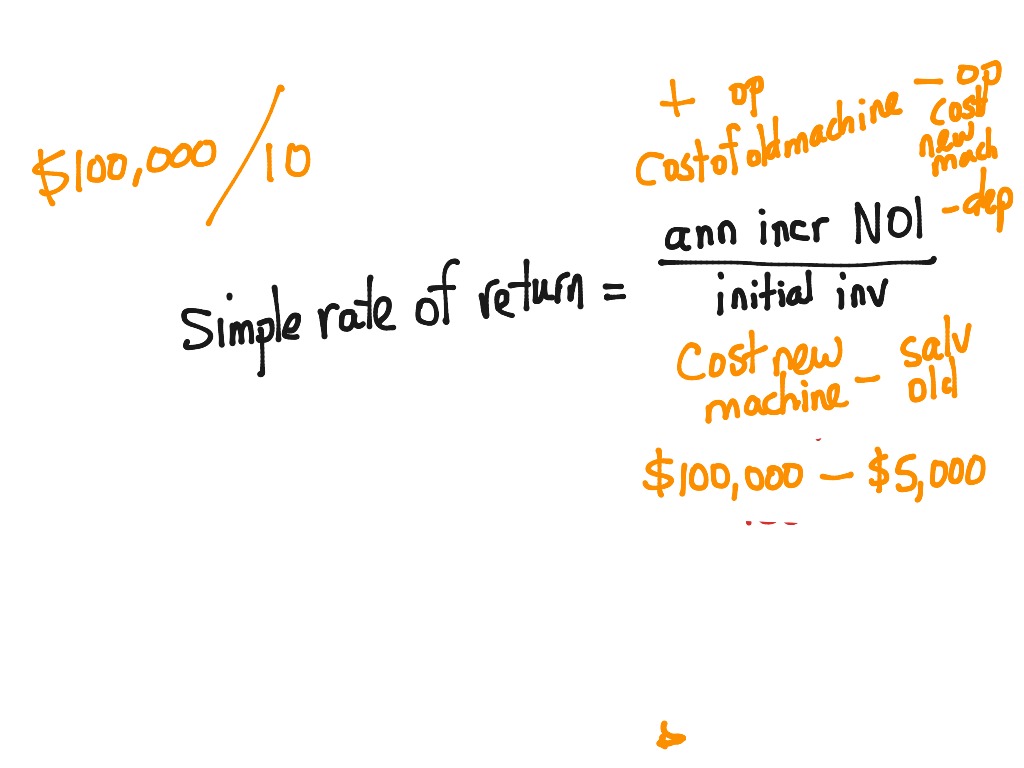

- The simple rate of return is considered a nominal rate of return since it does not account for the effect of inflation over time.

- Anna owns a produce truck, invested $700 in purchasing the truck, some other initial admin related and insurance expenses of $1500 to get the business going, and has now a day to day expense of $500.

- Withdrawing a large chunk of change at this time can destroy a portfolio and make it impossible to recover when the good market years show up.

- When the time length is a year, which is the typical case, it refers to the annual rate of return or annualized return.

- They are shown in a field ROI where you could see the value of ROI as a percentage.Did you know that you can also use the return on investment calculator the other way round?

The ARR is the annual percentage return from an investment based on its initial outlay. The required rate of return (RRR), or the hurdle rate, is the minimum return an investor would accept for an investment or project free invoice generator by paystubsnow that compensates them for a given level of risk. It is calculated using the dividend discount model, which accounts for stock price changes, or the capital asset pricing model, which compares returns to the market.

However, it is not required to completely liquidate the other position, as the difference between the two returns is minimal; as such, Joe is not harmed by holding Security A. He wishes to determine which security will promise higher returns after 2 years. Likewise, he wants to decide whether he should hold the other security or liquidate such a position. It is a very dynamic concept for understanding investment returns; hence it can be modified and tweaked a little to calculate returns from various avenues. It is important to note that short-term volatility is not necessarily indicative of a long-term trend. A security can be highly volatile on a daily basis but show long-term patterns of growth or stability.

Older Excel versions require pressing the Control, Shift and Enter keys after you key in the formula. This command makes the spreadsheet software convert the expression to an array formula—i.e., performing multiple calculations on one or more items in an array. If you’ve done that correctly, you’ll see brackets within the cell automatically. The data frequency depends on the rate of return you want to calculate.

Holding period return also takes into account any cash you periodically receive (such as dividends) from the investment over its holding period. The rate of return (ROR) is the compounded rate earned over an investment’s life. It assumes a constant compounded growth rate, even though the investment probably didn’t grow at a constant rate. In tandem with the concept above, the simple rate of return calculation also fails to account for the timing of cash flows.

بدون دیدگاه