Let us first find out returns from each security at the end of 1 year. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Types of Rates of Return

Developing this skill in an accessible yet in-demand software like Excel opens the door to a deeper understanding of investing that will help advance your skills. Learn how to select and manage investments with our Portfolio Management course. In an instant, our return on investment calculator makes all necessary computations and gives the results. They are shown in a field ROI where you could see the value of ROI as a percentage.Did you know that you can also use the return on investment calculator the other way round? Plug in the initial principal (invested amount) and the percentage of estimated profit (ROI) to find out what amount of money you can expect to earn. And last but not least, in the text below, you will find out how to use our return on investment calculator to make your calculations (and thus financial decisions) even faster and smarter.

Internal Rate of Return (IRR) and Discounted Cash Flow (DCF)

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. If you want to start investing or are looking for ways to improve on your investments, SoFi’s online investing app is a great way for you to start building up your portfolio.

Get up to $1,000 in stock when you fund a new Active Invest account.*

- After setting these variables, you will immediately know that Jack will gain a 4.277% return annually with a total withdrawal of $50,000.

- The rate of return forms a pivotal terminology for all the analyses related to investments and their returns.

- From the beginning until the present, he invested a total of $50,000 into the project, and his total profits to date sum up to $70,000.

- There are a multitude of other return metrics that can help you evaluate performance.

- The rate of return (ROR) is a simple to calculate metric that shows the net gain or loss of an investment or project over a set period of time.

This type of return considers the effect of compounding—the process in which an asset’s profits from one period can be reinvested to generate more earnings over the next. That’s very important in a portfolio context because the amount invested changes yearly as the assets realize gains or losses. The biggest reasons are inflation, and the fact that money you have now can be invested and gain interest over time. But the simple rate of return formula counts all income the same, whether it’s earned tomorrow or ten years from now. In other words, it does not adjust the income to its net present value.

If we deal with much larger amounts of money or with more complex numbers, it’s far more comfortable to use our return on investment calculator. Although the ROI calculator bases its calculation on the same formula, the usage of it is much faster and easier. With our tool, it’s enough only to type the invested amount and the returned amount to get your estimated ROI. Alongside other simple measures of profitability (NPV, IRR, payback period), ROI is one of the most frequently used methods of evaluating the economic consequences of an investment.

A good return on investment is generally considered to be about 7% per year, which is also the average annual return of the S&P 500, adjusting for inflation. Assume, for example, a company is considering the purchase of a new piece of equipment for $10,000, and the firm uses a discount rate of 5%. After a $10,000 cash outflow, the equipment is used in the operations of the business and increases cash inflows by $2,000 a year for five years. The business applies present value table factors to the $10,000 outflow and to the $2,000 inflow each year for five years. The nominal rate of return does not account for inflation, while the real rate of return does.

We have prepared a few examples to help you find answers to these questions. After studying them carefully, you shouldn’t have any trouble what is bank reconciliation definition examples and process with understanding the concept of ROI measure. You will also be capable of making smart financial decisions on the basis of ROI metrics.

An investment’s holding period return is the total return from holding an investment for a specific time (its holding period). This is different from an annualized return, which measures the return adjusted for a one-year period, which may be more or less than the actual holding period. Along with current income, HPR looks at the capital gains or capital losses of your investment.

This is most often used for a business reporting to its shareholders how much net income it earned compared to the amount of total shareholder’s equity. Simple rate of return is sometimes called the basic growth rate or return on investment. Retail investors, institutional investors, and even corporate decision makers use the rate of return to gauge the performance of their investments over time. The annualized rate of return is a slightly more complicated formula that solves the compatibility issues of the simple rate of return calculation by standardizing all calculations over an annual period. In this case, when you set $100,000 as an initial investment and -$12,000 for the periodic withdrawals, you will see that rate of return is 3.46% with a total withdrawal of $120,000. We can compute the rate of return in its simple form with only a bit of effort.

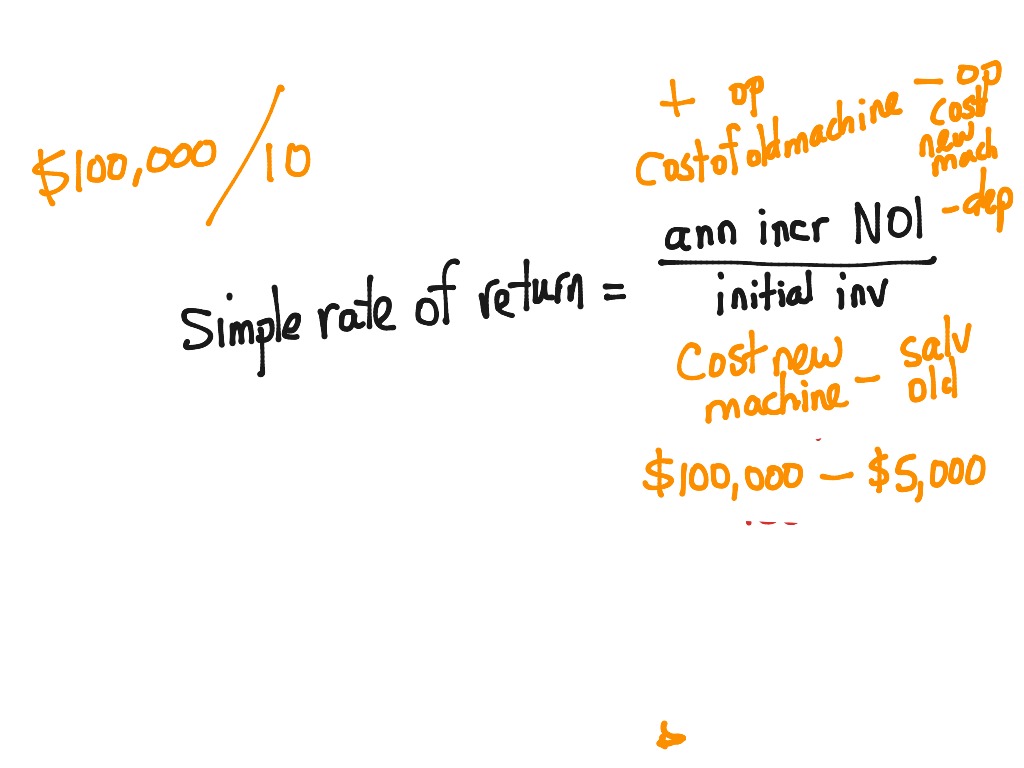

The first formula can be used only if the rate of return is compounded annually, while the second rate of return formula can be used for any growth compound frequencies. The problems enumerated here indicate that the simple rate of return is an excessively simplistic method to use for judging a capital budgeting request. Instead, consider such other techniques as net present value analysis and throughput analysis.

Say the cost of purchasing new equipment is $200,000, and you expect that it will also increase your operating expenses by $15,000 per year. You expect to get 10 years of use from it, and then sell it for $20,000, so the annual depreciation cost would be $18,000. Which figures do we need to calculate the stock’s rate of return in Excel? You want either the close price (which adjusts for splits) or the adjusted close price (which adjusts for splits and dividends).

بدون دیدگاه